Before we get into whether Bitcoin mining is still worth it, let’s explain briefly what Bitcoin mining is. Mining involves verifying transactions by solving algorithmic puzzles or finding blocks. This process increases the security of the Bitcoin Network and also earns the miner a small portion of the coins they produce or mine.

We have seen a rising interest in Bitcoin mining since its value rose from about 900$ per coin to about 20,000$ in less than a year. That increase was related to Bitcoin’s second halving, and now we are in a similar situation. On May 11, Bitcoin’s third halving occurred, and already we are beginning to see trends comparable to the bull run of 2017. And like last time, more and more people are looking to start mining themselves. However, is it still worthwhile to explore Bitcoin mining?

Bitcoin Mining Over the Years

Bitcoin mining has undergone different technological changes in the last decade. The genesis block was created on January 3, 2009. Back then, it was possible to mine Bitcoin using a regular personal computer. CPU mining was prominent in the beginning since there weren’t a lot of users or transactions. In other words, the processing power and energy needed to mine were relatively low.

As Bitcoin established a price on the market, people began to realize that they can earn more cryptocurrency by using faster hardware. This gave rise to GPU mining rigs, which were nearly six times more powerful than the best CPU mining hardware.

Shortly afterward, FPGA mining entered the scene. This hardware was able to compute the mathematical operations required to mine Bitcoin twice as fast as the currently available GPUs.

The changes happened quite rapidly, and the influx of people joining the Bitcoin network lead to a steep increase in the mining difficulty. Today, CPU and GPU mining is obsolete. In 2013, the most significant evolution to Bitcoin mining was introduced – the ASIC (Application-Specific Integrated Circuit). ASICs are computers built with only one purpose – to mine Bitcoin.

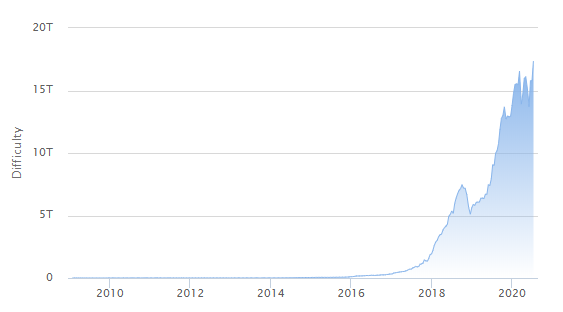

The super-machines rendered every mining device used before useless. The advent of ASICs further increased the Bitcoin difficulty, an upward trend that continues till today. While there have been new generations of ASICs every year, no new mining technology has emerged since then.

Bitcoin Mining and the ‘Difficulty’ Regulator

Bitcoin’s difficulty works as a regulator to maintain a stable production of verified blocks every 10 Minutes. This variable changes every 2016 blocks or roughly every two weeks. This ensures that Bitcoin production doesn’t go too low or too high. The higher the difficulty rate, the lower the amount an individual miner earns, and vice versa.

When it was first introduced, Bitcoin’s mining difficulty was 1. As of July of 2020, the difficulty has hit an all-time high at 17.35 Trillion. This difficulty level happened just a few days after the network reached an all-time-high ‘hash rate.’

Bitcoin Mining Profitability

Now that we have primed you on mining and difficulty, back to the main topic. So, is Bitcoin mining still worth it? This answer is yes, well, sort of. While there is money to be made from Bitcoin mining, the environment is a bit harsh for individual users. Mining, as it is today, is mainly a competition among large corporations. However, as an individual, if you have the right tools at your disposal, you could make it work.

Some ASICs allow the end-user to customize the hardware. This makes it easier to control the variables that affect profitability. For example, with the right tweaks, you could make an ASIC device require less electricity with minimal decrease in hash rate. In other words, the device can be configured to consume less energy, thus improving your net income since less money goes towards electricity.

It is, however, important for all new Bitcoin miners to find out their breakeven price for their current system setup before committing to a plan. The cost of electricity is the most crucial variable when analyzing how profitable you are going to be.

Some websites can also help you calculate the profitability of a single ASIC device. By simply inputting your device power in TH/S and your electricity rate, you can get a good idea of your total expenses and mining income at the end of each month. Something to keep in mind is that Bitcoin’s price is volatile, and the difficulty also changes every two weeks, so earnings for a given device may vary daily.

Final Thoughts

In closing, Bitcoin mining is still worth it if you have certain things going on for you, like cheap electricity rates and access to efficient and affordable ASICs. And, of course, mining profitability will receive an even greater boost if the Bitcoin price does us all proud.